Welcome to Insider Finance. If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

On the agenda today:

- Experts are expecting some growing pains for the Buy Now, Pay Later industry.

- Visa just jumped feet first into the bustling NFT market.

- Goldman's lending business is booming, thanks to wealthy clients and RIA clients.

Let's get started.

Hedge funds' big bets on startups come with complications

Hedge funds have been some of the biggest investors in private companies. It's a strategy that's paid off thanks to skyrocketing valuations among startups. But some are still hesitant to allocate money into investments that aren't easily liquidated. Here's why.

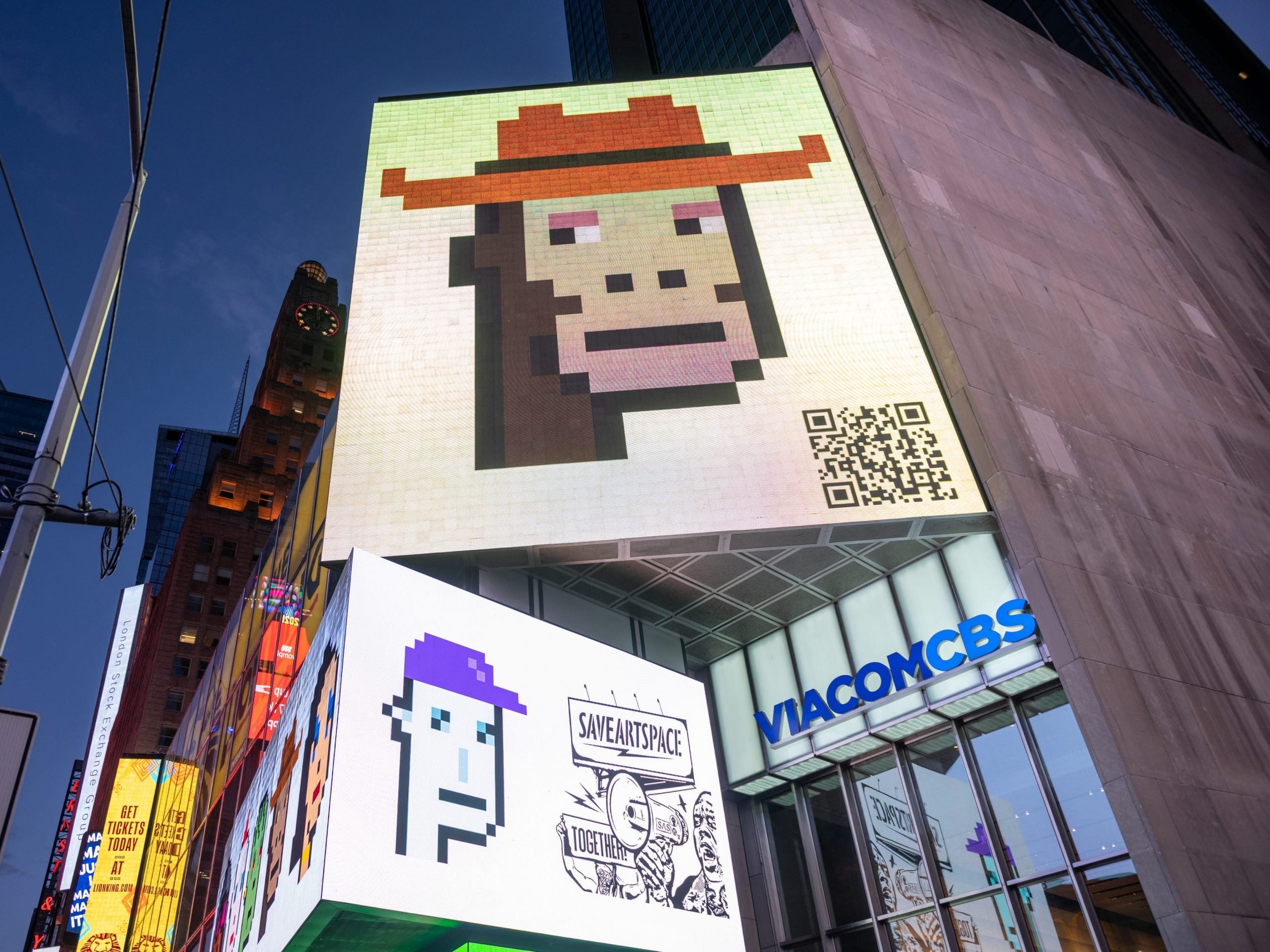

Visa leaps into the NFT market

Visa just made its first foray into the booming digital-collectibles market with its purchase of CryptoPunk 7610, its first non-fungible token. The payments giant bought the NFT for $150,000, "jumping in feet first" to help its clients better understand the non-fungible space. More on that here.

Similarweb, the alt-data industry's first public company, is putting its new capital to work. The web traffic-data company is boosting its partnerships with major corporations like Walmart, Google, and CNN - and everyone's paying close attention. Take a look at Similarweb's plans to scale up.

The role of the CEO is rapidly changing

Two years ago, CEOs from corporations like JPMorgan and Apple came together to embrace the idea that a company's goal shouldn't just be to make profits, but also to better society. Now, a new survey has found that many people believe CEOs are doing just that - and that many Americans approve. Here's what the role of the CEO looks like today.

Goldman Sachs' lending business is booming

The wealthy keep taking out loans they don't need, and it's meant booming business for Wall Street. Goldman Sachs expects its own lending business - which works with affluent and RIA clients - to hit $10 billion by the end of the year as the wealthy borrow to cover taxes and all-cash offers. More on Goldman's lending success.

Buy now, pay later could face growing pains

BNPL is booming, but experts are forecasting some challenges for the industry. Regulators and consumers are considering the risks of buy now, pay later, and concerns remain around merchant fees and credit risks. Here are the other major threats to BNPL.

JPMorgan is taking a $14.5 billion RIA to court

After losing at least 10 private bankers to Cresset, a registered investment advisory firm in Chicago, JPMorgan is taking the firm to court over an alleged raid and recruitment. The latest on what JPMorgan calls an "impermissible raid" of its staff.

On our radar:

- Spotify spent $230 million on Gimlet, but leaked data shows the podcast studio has lagged behind others at the audio giant. Insiders discuss what's holding it back.

- According to Reuters, the UK's competition regulator is investigating S&P Global's $44 billion purchase of IHS Markit. Here's what you need to know.

- Citadel is planning to redeem about $500 million of the $2 billion it put into Melvin Capital, WSJ reports. More on that here.

- This former Wells Fargo employee quit her job - to become a matchmaker. Here's how she turned her side hustle into a lucrative full-time business.

- Six paralegals shared why they felt like second-class citizens at their law firms. This is what they told us.